California lawmakers didn’t act quickly enough to halt the state’s cannabis excise tax rate from increasing to 19% on July 1, but industry stakeholders celebrated a better-late-than-never victory on Sept. 10.

California Senate VoteThe Assembly passed a bill on Wednesday that would rollback the 15% increase starting Oct. 1, and to suspend any further increases in the excise taxes until at least the 30th of June 2028.

This policy change has a significant impact on many cannabis retailers in the state.

California Department of Tax and Fee Administration reports that in 2024 approximately 1,200 dispensaries will have reported $4.9 billion of sales. In the case of the typical dispensary the difference in tax between 15% and 18% is greater than $100,000.

The Assembly adopted the legislation. Assembly Bill 564In early June, voted 74-0. It was approved by the Senate on September 11th, which means it will be sent to Gov. Gavin Newsom.

A.B. 564 was first introduced by Rep. Matt Haney of San Francisco in early February. Early February, Rep. Matt Haney (D-San Francisco) introduced A.B.

He pointed out, when Sen. Christopher Cabaldon D-Yolo introduced the bill on the Senate Floor this week that California’s cannabis market remains unregulated. dwarfed The unlicensed cannabis market has been booming for nearly nine years, after Californian voters approved Proposition 64 during the 2016 elections to legalize adult usage.

In passing Prop. Cabaldon stated that voters were looking for three main things when they voted on Prop.

- Cannabis made available legally and safely

- Close down illicit markets

- Supporting a variety of educational, environmental and social programs

He said, “That agreement is crumbling because the market has collapsed.” Today, the legal cannabis businesses of California only capture 40% market share. 60 percent of cannabis is sold illegally, without any protection for either consumers or the environment. California has lost ground.”

Cabaldon used a report commissioned by the California Department of Cannabis Control. Released to State lawmakers In March. A report prepared by ERA Economics LLC estimated that in California, 38% cannabis consumption in 2024 would be from the licensed market, whereas the remaining 62% was from sources unregulated and tax-free.

ERA Economics also estimated that non-licensed growers produced 11,4 million pounds of marijuana, which is roughly eight times the 1.4 millions pounds produced by licensees. Estimated 9 million pounds of cannabis left the state.

Californian licensed dispensaries provide some of the best cannabis products available. Cheapest cannabis prices In the U.S. it is also the market with the highest tax burden. A product’s retail price can often be increased by up to 44% after accounting for local cannabis business tax, state excise and sales taxes.

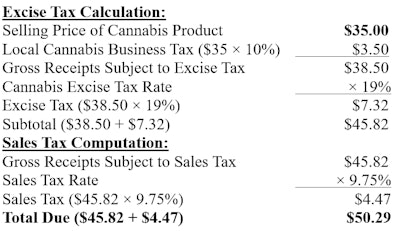

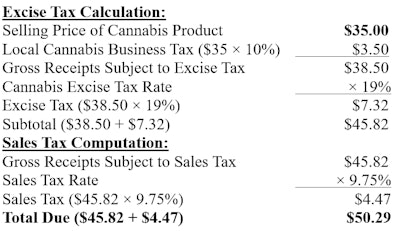

This is an example showing how the tax rate on a cannabis product worth $35 in Los Angeles currently stands at 43.7% for a total transaction of $50.29:

Although some people believe higher taxes will lead to increased tax revenues, this isn’t always true.

California misses out on $8 billion of unlicensed sales if $4.9 billion represents 38%. If California were to be able to secure 80% of market share, it could reduce the tax to 7.5% and still generate more revenue.

Sens. This was the view of Jerry McNerney (D-Pleasanton) and Tony Strickland (R-Huntington Beach), who expressed it during a Senate floor session on Sept. 10.

The nonprofit sector depends on tax revenue [and] McNerney added. But the larger picture is to reduce, contain and control the illegal market. Imposing taxes at this time will result in the opposite. “It’s going drive people to the black market for cannabis which is not a good outcome.”

Strickland commented, “It’s great that my co-workers now understand the negative effects of raising taxes on business. Now that you have understood that raising taxes is bad for those who provide the products, I can see that you now understand this. It is important to remember that lowering taxes are good for California businesses and economy.

A law was passed that increased the cannabis tax to 19%. A.B. 195Newsom Orchestration The trailer was attached to his state budget, which he had signed in June 2022. He reached a compromise with some cannabis tax revenue recipients to compensate for California’s Elimination A $161 per pound tax on cultivation is imposed.

Allocation 3 is the recipient of California’s Cannabis Tax Revenue. This includes a wide range of groups from youth and childcare programs to law enforcement, conservation, and environmental programs.

There are many representatives of tax-benefit organizations The following are some alternatives to the above: A.B. A.B.

A.B. Supporters of A.B.

A.B. A.B. 564 would require the DCC to consult the CDTFA, Legislative Analyst’s Office, and the CDTFA, and to submit to the Legislature a report by October 1, 2027 that analyses the impact of state’s Cannabis Tax Law on the regulated markets. This report should also include options to change the laws in order to achieve the legalization goal.

The industry is embracing the suspension of the excise taxes despite the fact that the Legislature has already committed to repeating this process in the next two years.

A.B. The passage of A.B.

She said, “This bill will protect consumers against dangerous illicit products and preserve the tax revenues that support essential programs such as child care or community reinvestment.” The Legislature realized that tax increases are a bad idea and stopped this one. They also recognized how smart policies increase revenue when they maintain a viable legal market. By driving consumers away from licensed dispensaries, the Legislature recognized that smart policy increases revenue by keeping the legal market viable.

O’Gorman added A.B. A.B. 564, if passed, will help save thousands of jobs on the country’s biggest cannabis market. 75,000 workers The state is a great place to start.

California lawmakers didn’t act quickly enough to halt the state’s cannabis excise tax rate from increasing to 19% on July 1, but industry stakeholders celebrated a better-late-than-never victory on Sept. 10.

California Senate VotingThe Assembly passed a bill on Wednesday that would rollback the 15% increase starting Oct. 1, and to suspend any further increases in the excise taxes until at least the 30th of June 2028.

This policy change has a significant impact on many cannabis retailers in the state.

California Department of Tax and Fee Administration reports that in 2024 approximately 1,200 dispensaries will have reported $4.9 billion of sales. The difference in excise taxes between 15% and 19% is over $100,000 for the average dispensary.

The Assembly adopted the legislation. Assembly Bill 564In early June,, a 74-0 majority voted to approve the bill. It was approved by the Senate on September 11th, which means it will be sent to Gov. Gavin Newsom.

A.B. 564 was first introduced by Rep. Matt Haney of San Francisco in early February. Early February, Rep. Matt Haney (D-San Francisco) introduced A.B.

He pointed out, when Sen. Christopher Cabaldon D-Yolo introduced the bill on the Senate Floor this week that California’s cannabis market remains unregulated. dwarfed The unlicensed cannabis market has been booming for nearly nine years, after Californian voters approved Proposition 64 during the 2016 elections to legalize adult usage.

In passing Prop. Cabaldon stated that voters were looking for three main things when they voted on Prop.

- Cannabis made available legally and safely

- Close down illicit markets

- Supporting a variety of educational, environmental and social programs

The market has collapsed, he explained. Today, the legal cannabis businesses of California only capture 40% market share. 60% of the cannabis market is illegal, with no environmental or consumer protections. California has lost ground.”

Cabaldon referred to a California Department of Cannabis Control Report (DCC), which had been commissioned. Notes to be released by state legislators In March. The report was prepared by ERA Economics LLC, and estimated that only 38% of the cannabis used in California would come from licensed sources in 2024, with the remaining 62% coming from non-regulated, untaxed, unlicensed markets.

ERA Economics also estimated that non-licensed growers produced 11,4 million pounds of marijuana, which is roughly eight times the 1.4 millions pounds produced by licensees. Estimated 9 million pounds of cannabis left the state.

Californian licensed dispensaries provide some of the best cannabis products available. Cheapest cannabis prices In the U.S. it is also the market with the highest tax burden. A product’s retail price can often be increased by up to 44% after accounting for local cannabis business tax, state excise and sales taxes.

This is an example showing how the tax rate on a cannabis product worth $35 in Los Angeles currently stands at 43.7% for a total transaction of $50.29:

Although some people believe higher taxes will lead to increased tax revenues, this isn’t always true.

California misses out on $8 billion of unlicensed sales if $4.9 billion represents 38%. If California were to be able to secure 80% of market share, it could reduce the tax to 7.5% and still generate more revenue.

Sens. This was the view of Jerry McNerney (D-Pleasanton) and Tony Strickland (R-Huntington Beach), who expressed it during the Senate floor session on Sept. 10.

Nonprofits rely on the tax revenue [and] McNerney added. We want to contain, control and reduce illegal markets. It’s not a good idea to raise taxes now. “It’s going drive people to the black market for cannabis which is not a good outcome.

Strickland commented, “It’s great that my co-workers now understand the negative effects of raising taxes on business. Now that you have understood that raising taxes is bad for those who provide the products, I can see that you now understand this. It is important to remember that lowering taxes are good for California businesses and economy.

A law was passed that increased the cannabis tax to 19%. A.B. 195Newsom Orchestration The trailer was attached to his state budget, which he had signed in June 2022. He reached a compromise with some cannabis tax revenue recipients to compensate for California’s Elimination A $161 per pound tax on cultivation is imposed.

Allocation 3 is the recipient of California’s Cannabis Tax Revenues. This includes dozens of groups, from youth and childcare programs to law enforcement, conservation, and environmental programs.

There are many representatives of tax-benefit organizations The following are some alternatives to the above: A.B. A.B.

A.B. Supporters of A.B.

A.B. A.B. 564 would require the DCC to consult the CDTFA, Legislative Analyst’s Office, and the CDTFA, and to submit to the Legislature a report by October 1, 2027 that analyses the impact of state’s Cannabis Tax Law on the regulated markets. This report should also suggest ways to amend the state’s cannabis tax law so that it achieves the goal of legalization.

Industry stakeholders see the suspension of the excise taxes as a victory, despite the Legislature’s plans to do this again in 2 years.

A.B. The passage of A.B.

She said, “This bill will protect consumers against dangerous illicit products and preserve the tax revenues that support essential programs such as child care or community reinvestment.” By stopping the misguided increase in tax, the Legislature has recognized the fact that a smart policy will grow revenue by maintaining the viability of the legal market. By driving consumers away from licensed dispensaries, the Legislature recognized that smart policy increases revenue by keeping the legal market viable.

O’Gorman added A.B. A.B. 564, if passed, will help save thousands of jobs on the country’s biggest cannabis market. 75,000 workers The state is a great place to start.

Cannabis Law Resources in Poland

Discover essential legal information about the cultivation of cannabis, its sale, and regulations governing medical products in Poland. These guides will help you understand the legal requirements, such as certifications, permits, and compliance.

-

Polish News Registration and Interests of Cannabis Businesses

-

Permissions for Cannabis Sales in Poland

-

Authorization for Importing or Manufacturing Medical Products

-

Permission for Manufacturing or Importing Medical Products

-

Certificate of Good Manufacturing Practices (GMP)

-

Registration of Medical Products in Poland