According to conventional wisdom, bigger is always better. The more stores, the better. In a difficult economy, premium prices cannot survive.

Florida’s marijuana market has not listened to the warnings. The state’s smaller companies are performing better than traditional retail measures, and new operators will likely shake up the market further.

Market leader Trulieve Cannabis Corp., (OTCQX TCNNF), maintains a dominant position with 38% flower sales. Boutique operators achieve comparable efficiency per store with only a fractional retail footprint. State data, for example, shows that Jungle Boys has captured 3 percent of the cannabis market despite only having 1.12% of dispensaries in the state.

Flowery, a boutique with 10 locations in the United States, has built its brand on its premium product line and comprehensive delivery network, rather than on retail dominance. The stores are regional hubs for service across Florida and do not follow the traditional corner store approach of larger operators.

Florida’s medical marijuana program now serving 900,000. The unexpected success is due to the fact that it has been able to withstand greater challenges and an abundance of supply. It’s difficult to determine the exact degree to which increased spending is due to falling prices or an increase in demand.

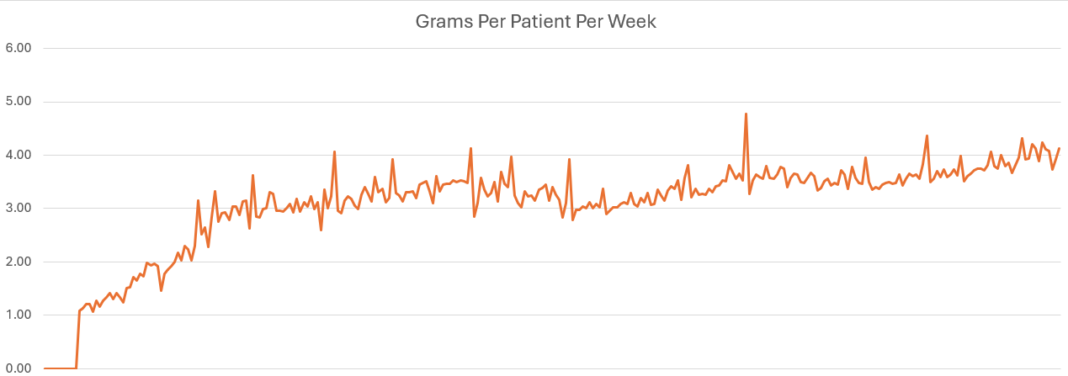

Andrew Livingston is the director of research and economics at Denver’s cannabis law firm Vicente. He says that because the state does not track price, it can be difficult to tell if an increase in per-patient sales is due to increased consumption.

Livingston said that if the rise in the number of patients were just friends who bought cards for their own use, then the average sales per patient would fall. We don’t observe that. “We’re observing sales per patient increasing steadily.”

Florida’s licensees are few, but its network of locations for dispensing is extensive. Florida is the only state with 60+ stores managed by companies.

In Florida, an average dispensary has 1,200-1300 patients and, if you use conservative figures, this would yield $2.3 to $3 millions annually.

Trulieve’s market share is more than just the number of stores. The company controls 21% retail outlets, but also 31% market share for concentrates. But the market accommodates a wide range of business models from large-scale operators to niche premium players. This is especially true if you include adult-use.

Could they maintain their quality and pricing if there were more of them and they tripled or quadrupled the size of each store? Livingston spoke about the possibility of boutique operators expanding under adult usage.

Some segments, however, have virtually disappeared. The sales of low THC medical cannabis dropped 90 percent in just two months. This is more likely to be due to reporting changes than consumer behavior. GMR. Meanwhile, traditional medical cannabis sales continue climbing despite competition from hemp-derived products – a newly controversial channel that Gov. Ron DeSantis, the state GOP leader and other officials have been cozying up to hemp-derived products.

Most of the dispensaries here are focused this year on optimization, rather than growth. Success increasingly depends on execution rather than footprint – whether through Trulieve’s scale advantages, The Flowery’s premium positioning, or somewhere in between.