Nextleaf Solutions Ltd., a cannabis processor (CSE OILS), (OTCQB OILFF), (FSE L0MA), reported a strong growth in revenue for fiscal year 2024. However, higher operating costs pushed it into a losing situation.

Vancouver-based firm reported gross revenues of $16.6 millions for the fiscal year ending September 30, 2024. Net revenue after excise tax was $12,5 million, an increase of 53% over $8,2 million for fiscal 2023.

Nextleaf, however, recorded a $1.4 million net loss for the fiscal year after accounting for all operating costs, which included $1.35 in stock-based compensation. This compares to a $223 334 net profit in fiscal 2023.

Emma Andrews stated in a press release that “this was a year where we executed on the basic principles.” “We have been scaling up manufacturing operations and inventories to support the advancement of our business strategy and stay up to date with consumer demands.”

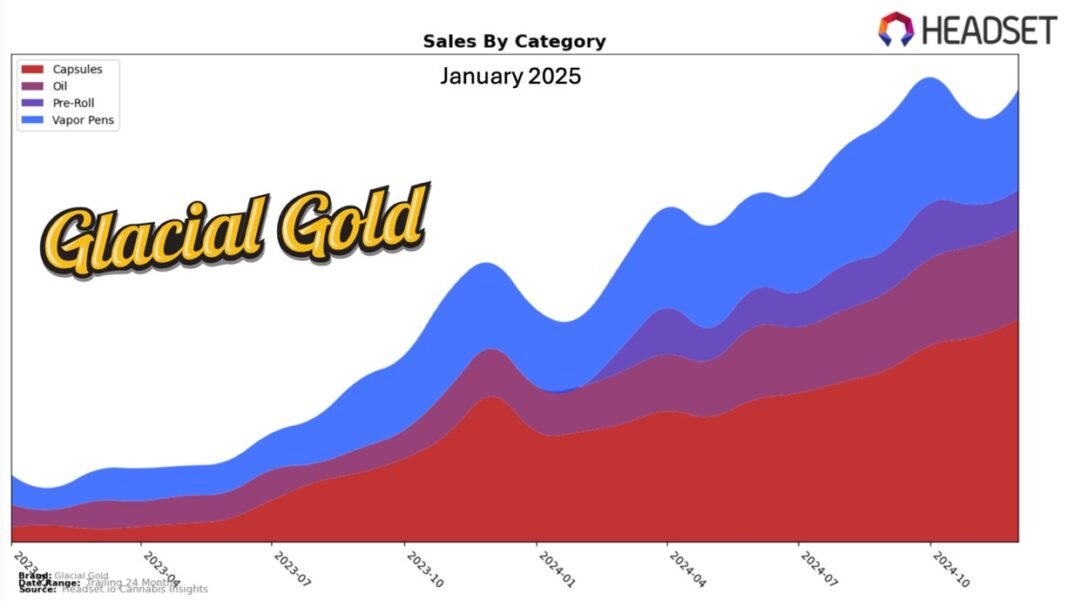

According to an announcement, the company’s Glacial Gold flagship brand gained popularity in Western Canada. It ranked as the leading softgel brand for British Columbia, and maintained the position of number one in softgel sales throughout Alberta between September 2024.

Nextleaf said that it also expanded its retail presence during fiscal year 2024 by obtaining 44 new listings of products in British Columbia, Alberta, and Ontario. Now, the company’s product line is available in nine provinces.

In addition to infused prerolls, the company has a large product line of smokeless cannabis, such as oils, softgels and vapes. The company has also branched out into cannabinoid minor formulations with CBG, CBN and multiple categories.

Nextleaf has set several goals for fiscal 2025. These include improving its operational efficiency with a new Enterprise Resource Planning system, and extending its commercial partnership program by expanding ingredient supply activities and contract manufacturing.

It also plans to explore international opportunities for ingredient exports in Europe, South America and Europe.

The company reported a positive EBITDA adjusted of $675.613 for this year, despite the loss. The gross profit increased to $3.7million from $2.3million in fiscal 2023.

This is after Nextleaf’s challenging third quarter, where it recorded a loss of C$317,000 despite an increase in revenue by 50%.