Pre-rolls have become increasingly important in shaping the future cannabis market, both on the US and Canadian side.

James Valentine is the owner of Custom Cones USA & DaySavers

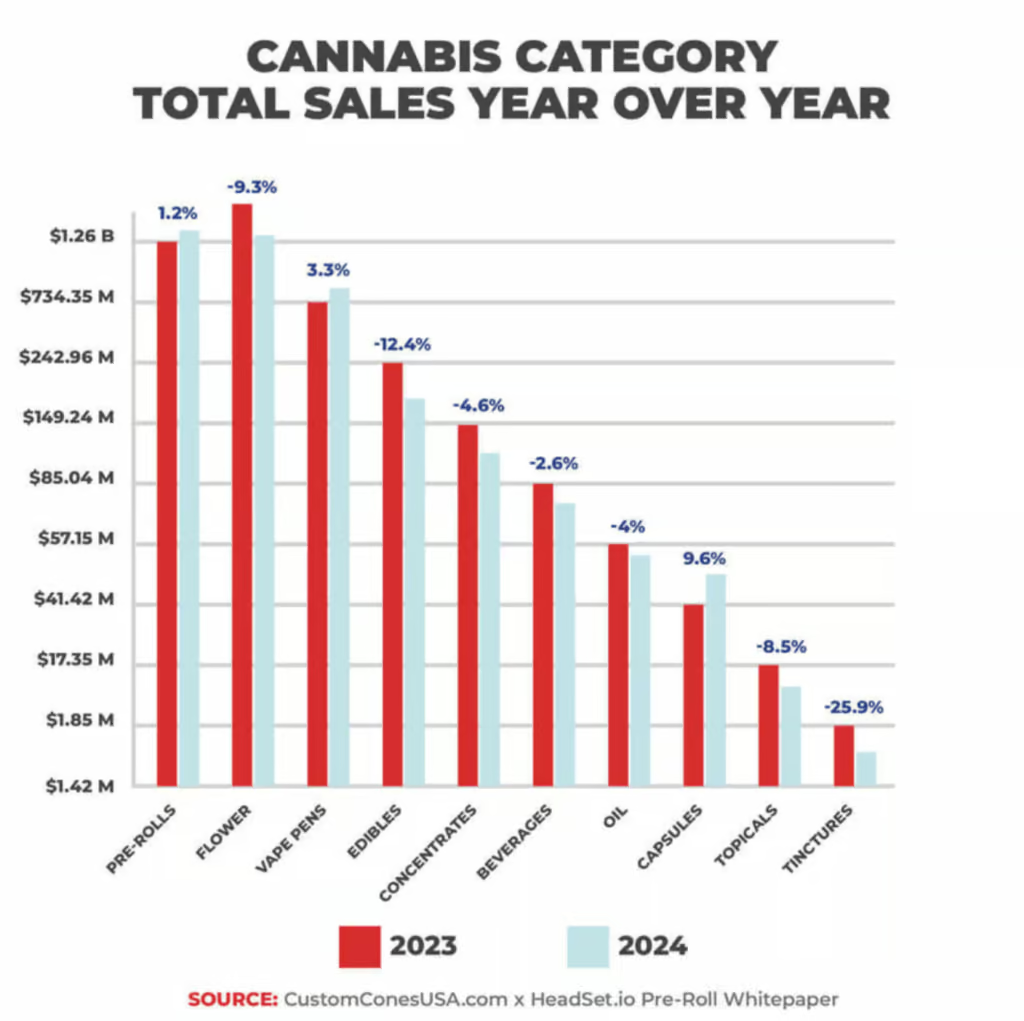

Cannabis continues to be a multibillion-dollar industry in Canada and the U.S., and while both countries share the same top product categories—flower, pre-rolls and vape pens—market maturity and consumer preference vary greatly, creating two distinct markets with different product landscapes and market shares between the categories.

Custom Cones USA, in partnership with Headset, a cannabis-industry analytics firm, analyzed data at retail points of sale from 16 locations across the two countries.

Canada’s marijuana market has seen its first revenue decline since the national legalization of cannabis in 2018. Sales fell by 3.27 per cent due to an astounding drop in sales for edibles and flowers totalling $128 million. Sales of pre-rolls, on the other side, continued to increase.

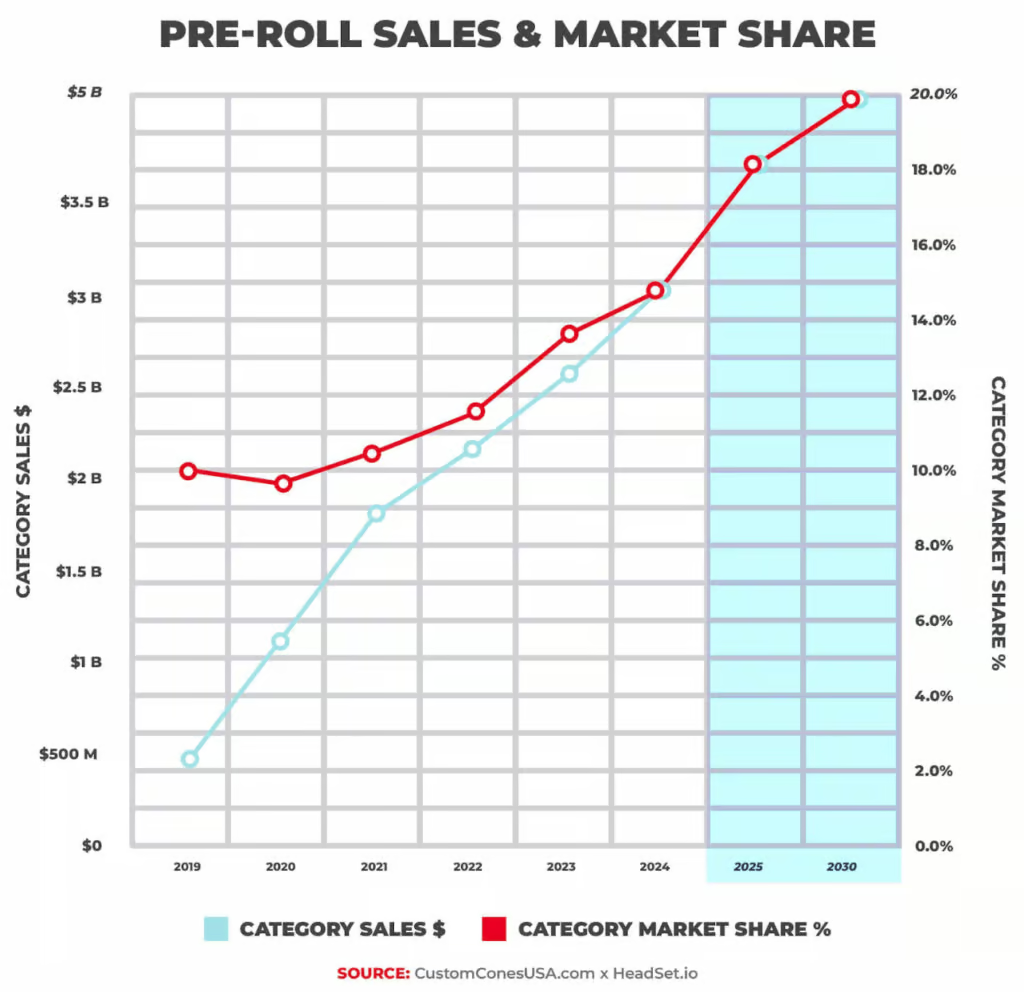

Pre-rolls have been the fastest-growing cannabis category in the last two years. They are expected to grow 12 percent by 2024.

While overall cannabis sales in Canada decreased last year by 9.3 percent, flower and edibles saw a loss of 12.4% and 11.4% respectively. The pre-roll market, while still increasing, is reaching saturation. In the year prior, this category had a revenue growth of 38 percent.

The U.S. sales of pre-roll in 2024 will be $4.1 billion, gaining 2.7 percent in terms of market share, and increasing sales revenues from $181 millions in January to $257 millions in June.

The two markets are too different in size to be compared. Canada sold 68,7 million prerolls last year while American sales reached 324,5 million.

Although sales figures often represent population size, the differences between pre-roll markets of two countries are obvious. This number in Canada is twice as high (32%) than the U.S. (16%). Pre-rolls surpassed flower for the first six months in Canada. Although flower returned to the top of the charts by year’s close, it was only by a small margin, 0.25 per cent, over pre-rolls. That is, $11.4 millions more sales.

Pre-rolls have a 14 percent share in the US, while flower has a 41-percent share. Pre-roll sales in the U.S. have increased each year for five years. In 2024, they will reach $3.1 billion, compared with $469 million last year.

Canadians are 2-to-1 more likely to prefer pre-rolls than Americans.

Consumer pre-roll preference

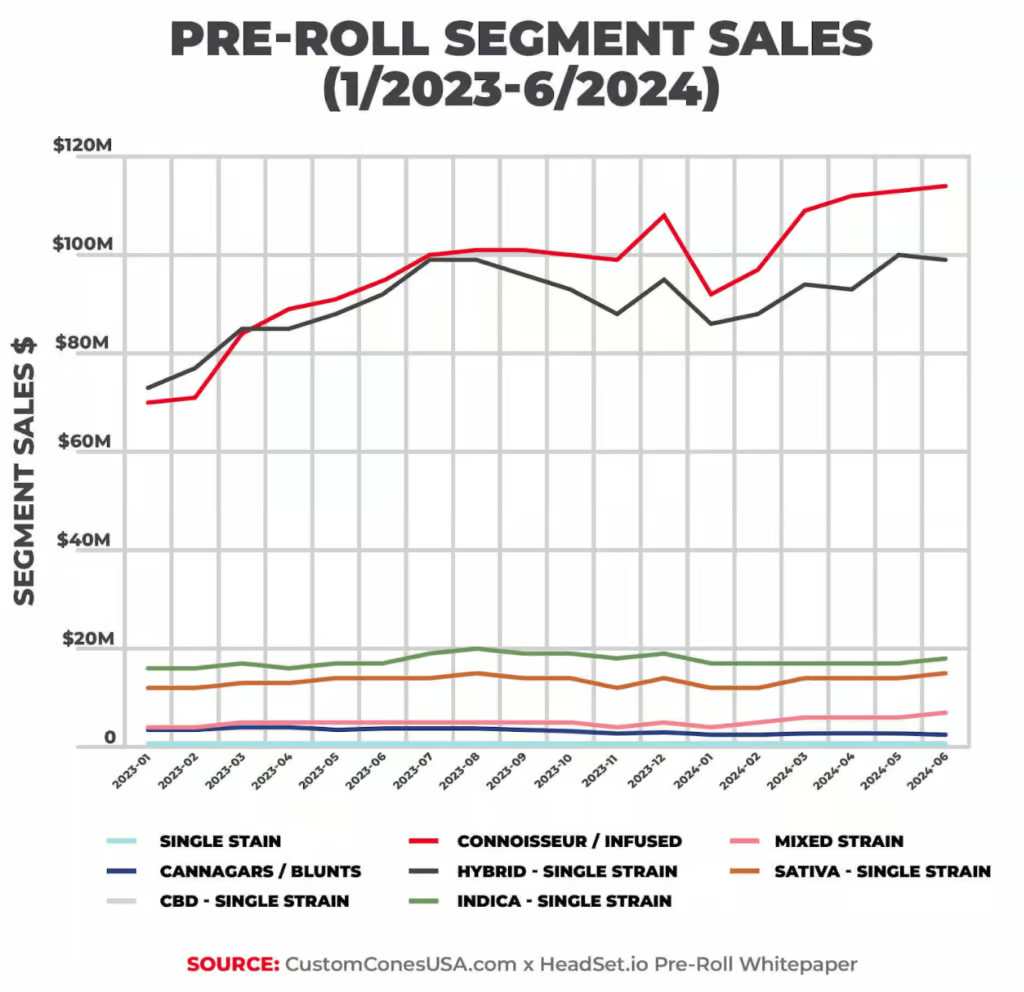

In spite of the large discrepancy in market shares between American and Canadian, the segment preferences within this category are very similar. Hybrid, single-strain, pre-rolls have a slight edge over infused, while in the US, infused, pre-rolls outnumber hybrids.

Canadian hybrid single-strain Pre-rolls generated $483 Million, an increase of 8.3 Percent YoY, and a total sale of $37 Million. The U.S. hybrid market grew 35 percent in 2023-2024. Sales of $1.64 billion were generated during this time.

Pre-rolls infused with American tobacco raked in $1.75 billion, or 44 percent of the pre-roll market. Sales for Canadian pre-rolls infused with American tobacco increased by 6.5 percent from 2023-2024 to $457 millions.

Indica single strain pre-rolls and sativa pre-rolls are No. Indica and sativa single-strain pre-rolls are ranked No. Indica is the No.4 in both countries, and sativa comes in at no.3 in each. Pre-rolls infused with hybrids and other strains sell more than 300 times as much in Canada. This number is 500% higher in the United States.

In both markets, the remaining pre-roll segments—mixed Strain, CBD, single strain and blunts—make up just 5.5 percent of pre-roll sales in Canada and 7 percent in the states.

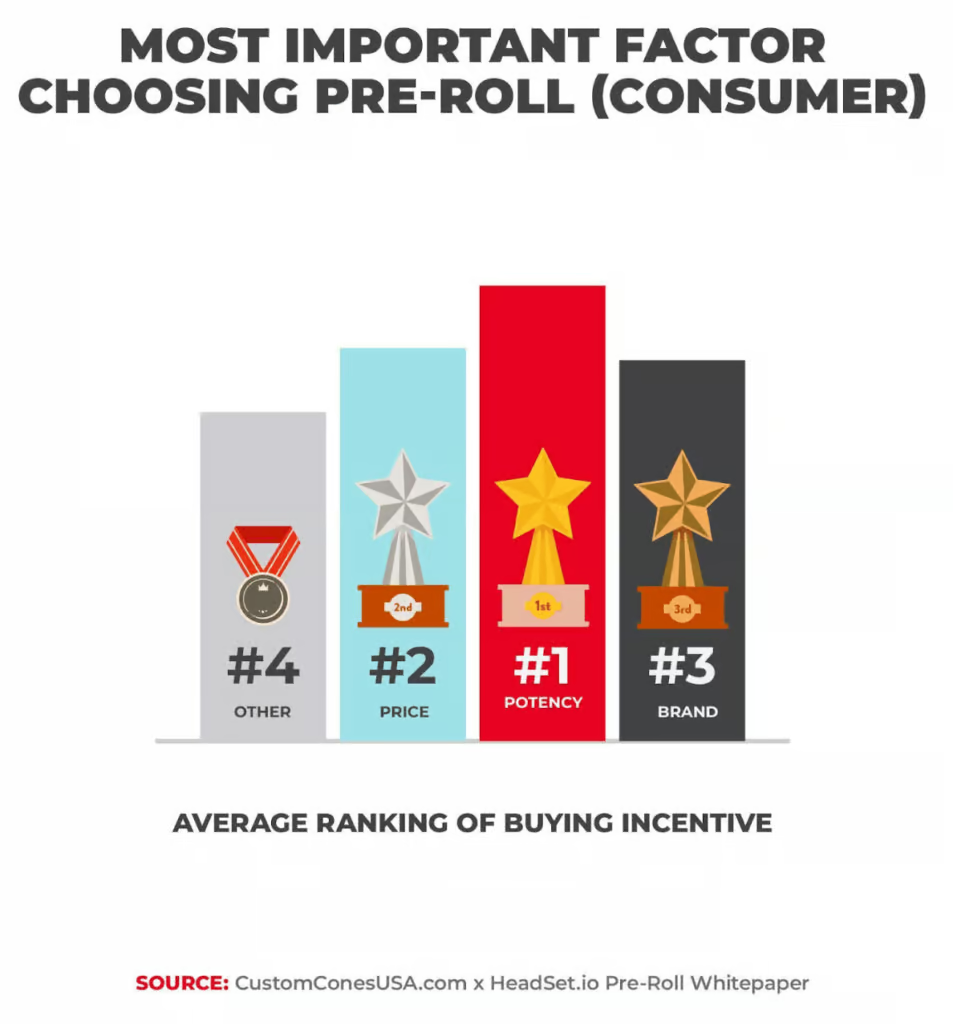

Potency, price, strains and brand loyalty were all considered important by consumers in both countries when choosing pre-rolls.

In both the American and Canadian markets, pre-rolls are most popular in warmer months. Their market share is highest in early autumn, late summer and spring. This trend in Canada led pre-rolls to become the most popular cannabis product for those months. They peaked at 3 percent over flower during July.

Pre-rolls are predicted to be the most popular cannabis product on the Canadian market by 2025. While the flower category dominated the Canadian market for the first half of 2024 (from 4 to 25 percent), the lead shrank from that in 2023, to just 0.25 percent.

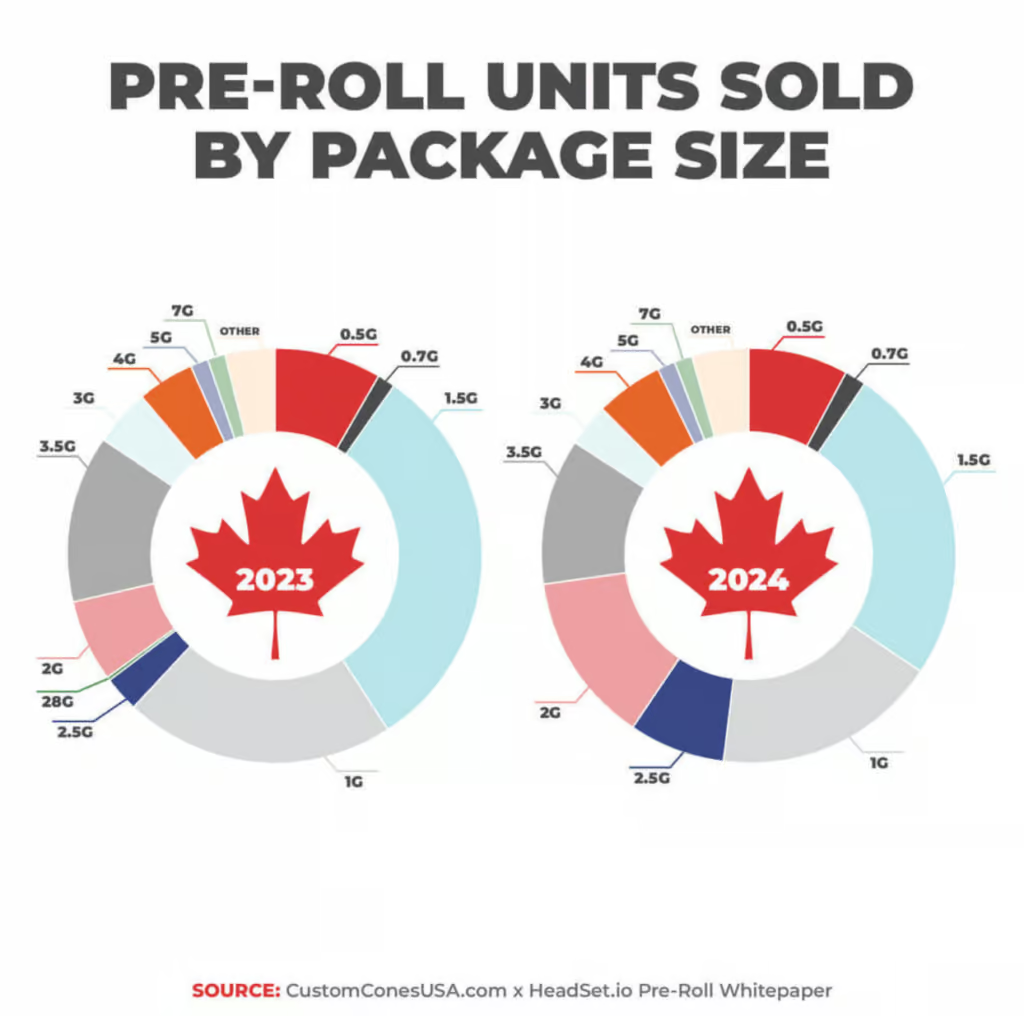

Customers prefer the package size.

In Canada, multi-packs dominate the pre-roll market with 85 percent. The classic single-gram pre-roll makes up only 11 percent. The U.S. multi-pack market is nearly half the size of Canada’s pre-roll market. Between the start of 2023 to the middle of 2020, sales increased 43 percent.

Pre-roll packages of 1 gram are the most popular size for Americans, with 42.3 percent sales. This is nearly four times more than Canadians.

In 2024, there will be over 15,000 pre-rolls on the U.S. marketplace, of which nearly 8,900 are the 1-gram single-gram pre-roll. Over the same period, approximately 5,000 multi-packs were introduced.

In the United States, the most popular size of multi-pack is a 5-pack that contains 2.5 grams. This represents 16 percent in total sales for pre-rolls YoY. Canada’s most popular multi-pack size is the 1.5-gram 5-pack, which accounts for 26 percent of total sales. Canadians are beginning to prefer multi-packs more in line with American preferences. 1.5-gram packs have lost 7.1 percent of their market share, while 2.5- and 2-gram multipacks gained 3.3 percentage market share.

The producers are adapting their products to the new multi-pack preferences. Canadian producers are increasing their 2 gram and 2.5 gram pre-roll offering by 85% in 2024. They will release 282 more products. Multi-packs made up 32 percent in the US, compared with 68 percent for single pre-rolls, and nearly 87 per cent of these were the 1-gram single pack.

Price comparison of Pre-Roll

Due to the popularity of multipacks, the average cost of a pre-roll in Canada is 18.43 Canadian dollars ($6.50 US), despite the fact that the American equivalent costs only $6.50. The addition of cannabis concentrates into pre-rolls makes the average even higher.

To put this in context, the price of the most popular hybrid single strain segment is $7 higher than that of the Canadian average infused preroll. The average price of pre-rolls in Canada has increased by $0.41 year over year, which indicates an increase in the number of infused products available on the market.

In 2024 the pre-roll average price in the U.S. fell by $0.70 (a 16.7 percent decrease) despite a surge of ultra-premium products with high potency. Price decreases in the infused market were also 23 percent YoY. The segment went from $8.80 to $11.50, which is a considerable drop.

While the price of pre-rolls is decreasing in the United States, sales of the product have skyrocketed. From early 2023 until mid-2024 an extra 10 million pre-rolls were sold each month, and 26 million pre-rolls had been sold by June 2024.

Pre-rolls remain the top category for both countries, both in terms of unit sales and revenue.

Pre-roll 2025 outlook

Pre-rolls will continue to grow in terms of revenue and sales units in the Canadian and American markets in 2025, following years of steady growth.

It may appear that growth has reached saturation in Canada with its modest growth of 1.2 percent in 2024. Flower lost over 9 percent market share, which is equivalent to $145 millions, in 2024. We’re confident, however, that the pre-roll category will grow and surpass flower in Canada by 2025.

If the U.S. pre-roll industry continues at the current rate, pre-rolls are expected to add 2 to 3 percentage points to the market through 2025. This would translate to sales of well over $4 Billion in the U.S. alone, especially in mature markets. Pre-rolls infused with nicotine have gained 10 percent in market share since 2019. We anticipate that this growth will continue. The current percentage of infused products is around 44.5 per cent.

Pre-rolls are preferred by Canadians 2 to 1. This is in spite of multi-packs costing more than in the U.S. The relative growth rate in the U.S. pre-rolls market (11.9%) was ten-times that of its northern neighbors (1.25%). No matter what the market is, pre-rolls have always been a favorite of both consumers and producers.

Our 2024 U.S. Report surveyed 300 U.S. brands about the expansion of their pre-roll brand. And keeping up with trends, adding infused and multi-packs is at or near the top.

Producers are constantly adapting their products to the ever-changing preferences of consumers.

Pre-rolls will continue to shape the future cannabis market in Canada and the United States as we approach 2025.

James Valentine, the Communications and Content Marketing Manager for Custom Cones USA & Daysavers.

I was saved by psychedelic medicine after my Navy career. Congress should act to give veterans access (op-ed)